Mistakes happen. Whether it’s a misplaced decimal point or accidentally paying the wrong person, even the most meticulous of us can stumble when navigating bills, clients, and colleagues through QuickBooks. But fear not, fellow bookkeeper! The handy void feature in QuickBooks allows you to erase these electronic faux pas before they wreak havoc on your finances. With a few simple clicks, you can essentially nullify a check, rendering its value to zero. Though the voided check remains in the register as a record, its impact is neutralized. This way, the register maintains a clear audit trail, detailing the check’s number, payee, and date, while preventing any financial repercussions.

For deleting the check with the transactions, you need to follow the process how to Void a Check in QuickBooks. You can also check the removed checks in the future. Also, all the details and transactions of the check will be the same in the QB Account.

What is Void a Check in QuickBooks?

In the case, you want to reverse the deleted amount or cancel the check then you need to use void checks. You will get the transactions to record back if the void check does not delete all the history. It is highly used for damaged transactions in QuickBooks. You may require it due to wrong entered details like amount information, payee, amount, data, and more. The term voided check represents that the user has removed the original transactions.

Voiding vs. Deleting in QuickBooks

If you consider the accounting point of view then no difference is there in between deleting and voiding a check-in QB. Both can remove the transactions from the financial statements. As per the recordkeeping perspective, voiding a check is more appreciable than deleting. Void a check can retrace the transactions that are checked. Voiding means converting the balance to zero likewise deleting means removing the complete transaction.

Void a Check Process in QB Desktop

Steps are mentioned below for bill payment check or general bill:

- Choose check register.

- Choose the option “Check to void”.

- Void the check.

Detailed steps are mentioned below of above steps for how to Void a Check in QuickBooks :

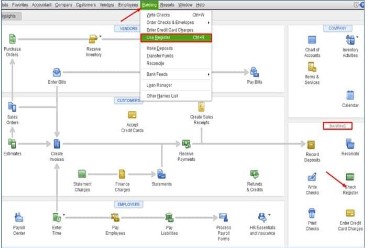

Choose Check Register

- Open QB Desktop.

- Have the Home page.

- There you need to choose the option Banking menu.

- Click on the option Check Register.

- From the drop-down list, select the icon Register.

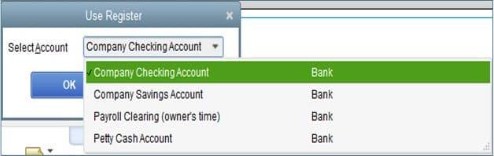

Select the Check to Void

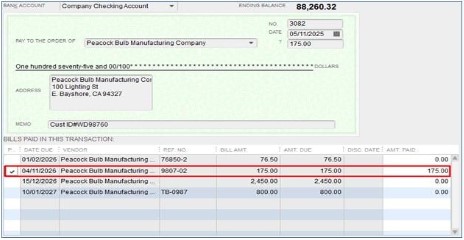

In this step, you need to select the bank account that you want to void.

You will see a window showing all the accounts and checks. Choose the void by double-clicking on the line anywhere.

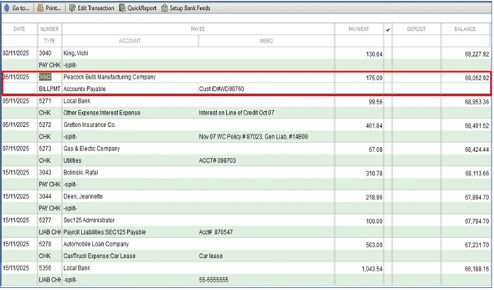

Void the Check

You will see the list of outstanding bills after choosing the check using the previous list:

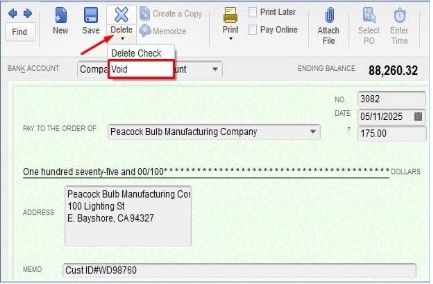

On the top, you will have the menu Delete. Under the Delete menu, choose the arrow small dropdown and at last tap on the option how to Void a Check in QuickBooks :

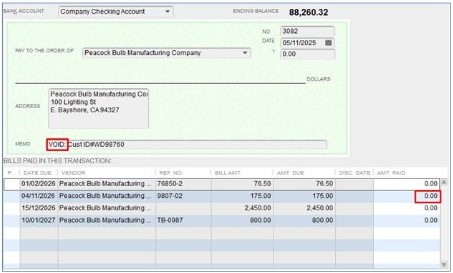

Just after a click on the option Void, you’ll see that the amount will become zero. In the memo field, a void is also displayed.

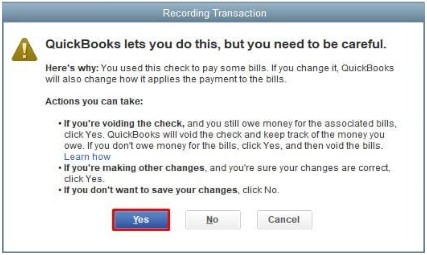

Now choose the option “Save & Close”, that message QuickBooks to record the changes that appear on the screen then choose the option Yes to proceed further:

How to Void a Check in QuickBooks?

Steps are mentioned below to void a check in QuickBooks Online:

- Open QB,

- Look at the left menu and choose the option “Accounting”.

- Similarly, look at the top menu and choose the option “Chart of Accounts”.

- Choose the bank account which will be checked.

- Choose the option “View Register”.

- Find the check which user wants to void.

- To highlight it, click on it.

- Now click on the icon “Edit”.

- Choose the option “More” and then select “Void”.

- Confirm to get voided the check.

When it is Needed to Have the Void a Check Process in QuickBooks Desktop?

You need to void a check in QuickBooks Desktop in the following cases mentioned below:

- A duplicate check is created.

- Incorrect amount.

- Incorrect date.

- Check is stolen or lost.

- If the check is issued to an incorrect person.

- Due to some incorrect check locations.

Frequently Asked Questions (FAQs)

Q. How to perform void a check-in QuickBooks desktop?

You can easily void a check-in QB Desktop by following the steps mentioned below:

Choose check register.

Choose the “Check to void”.

Void the check.

Q. How to execute the process of the void check-in QuickBooks 2023?

The process is similar in the case of QB 2023, look at the steps below:

Choose check register.

Choose the “Check to void”.

Void the check.

Q. When should you void a check in QuickBooks?

You need to compulsory void a check when the following situations will occur:

A duplicate check is created.

Incorrect amount.

If the check is issued to an incorrect person.

Incorrect date.

Check is stolen or lost.

Incorrect check locations.

Q. What happens when you void a check-in QB?

Void a check-in QB means the balance becomes zero and hence the check is not valid for payment purposes. By mentioning “VOID” on a check you can be protected against fraud. One should keep a record of the voided check so that you can be prevented from fraud as a number check can be there.

Q. Can I delete or void a check-in QuickBooks?

In case, you want to delete the checks then you don’t have any record to display. This process will delete the transactions. These deleted checks can be easily recoverable from the available trails.

- Delete a check-in QuickBooks

- Open QB Account.

- For opening the window, tap on the Write checks.

- A drop-down button will be displayed on your screen.

- Find the option Edit.

- Now click on the Delete check.

- A window of deleted Transactions will be displayed.

- Press the button OK.

- Now make sure to check whether it is permanently deleted or not.

Q. How to execute void an unused check in QuickBooks online?

To do steps are as under:

- Open the menu “Banking”.

- Select the option “Write Checks”.

- Choose any bank account that will be checked.

- Create a check using a 0.00 dollar amount.

- Add the name in the field Payee.

- In the Expenses field, assign any account.

- Choose the menu “Edit”.

- Hit the option “Void Check”.

- Click the option “Save and Close”.

Q. How to void a check in QuickBooks without affecting prior periods?

It is very easy to void a check without affecting prior periods by considering the steps mentioned below:

- Open the check register.

- Select the check which you want to be voided.

- Choose the option “void check”.

- Add the journal entry date as same as the date on the original check.

- Choose the account which will be debited after the check is created.

- Add the amount in the respected column.

- Review the checking account from which the original check was written.

- In the credit column, add the check amount.

- Made a journal entry and reverse the entry in b.

Q. How do I void a check payment in QuickBooks?

To void, a check payment in QB steps are as under:

- Open QB Desktop.

- Login to your account.

- Visit the menu Customers.

- Choose option Customer Center.

- Visit the tab Transactions.

- Choose the option Received Payments or Sales Receipts.

- Access the payment or receipt.

- Visit the menu Edit.

- Choose the menu Void Sales Receipt.

- Hit the icon Save & Close.

1-877-589-0392

1-877-589-0392